Money laundering is a complex and insidious crime that has the potential to destabilise economies, corrupt institutions, and fund illegal activities such as terrorism and drug trafficking. At its core, money laundering is the process of making illicit funds appear legitimate by disguising the source of the funds and making them seem like they were obtained through legal means. In this blog, we will explore the motivations behind money laundering and why criminals engage in this illegal activity. Following that, I’ll be sharing my point of perspective and the reason behind money laundering.

The case of Donald Trump

A lot of people have been wondering over the last couple of years, why Trump frequently seems so deferential to Vladimir Putin or friendly towards Russia. There was a conference in 2018, between Trump and Putin, and Trump addressed the press saying that “During today’s meeting, I addressed the issue of Russian interference in our elections with President Putin. I have great confidence in the intelligence of my people, but I will tell you that President Putin was extremely adamant and unmovable in his denial today.”

The Investigation

There have been multiple investigations into potential money laundering between individuals and entities in the United States and Russia. One high-profile investigation is the one led by special counsel Robert Mueller into possible collusion between the Trump campaign and Russia during the 2016 US presidential election. As part of this investigation, Mueller also looked into potential financial ties between individuals associated with the Trump campaign and Russian entities. In addition, several banks have been investigated for potential money laundering involving Russia. For example, in 2018, the US government fined the French bank Société Générale $1.3 billion for violating US sanctions and engaging in money laundering, including with Russian entities. More recently, in 2020, it was reported that the US Treasury Department was investigating several banks for potential money laundering involving Russian oligarchs, including Deutsche Bank and Bank of New York Mellon. So, the possible allegations are that President Trump, when he was a businessman, before he became president, may have had these ties with Russians who were engaged in money laundering. As a businessman, that’s one thing, and we’d be concerned about that because of the possible criminal violations and the laundering taking place. Now, as president, you get into a whole other area of concern, which is, does that give people in Russia any leverage over the president? For more details, go through this website- https://www.theguardian.com

Money Laundering

Buying a luxury condominium with cash isn’t illegal, and buying in the name of a corporation or an LLC is not illegal on its own.What would make it illegal is if you’re doing that with criminal proceeds.So if you’re a Russian oligarch and you’ve got all this money from your corrupt operations over there, you want to park your money in someplace safe where people won’t ask questions about it.There was a study that found that there were more than 80 purchases from people either in Russia or other former Soviet states who were paying cash for condos or other units in Trump-owned properties,Trump Organisation valued at more than $100 million.

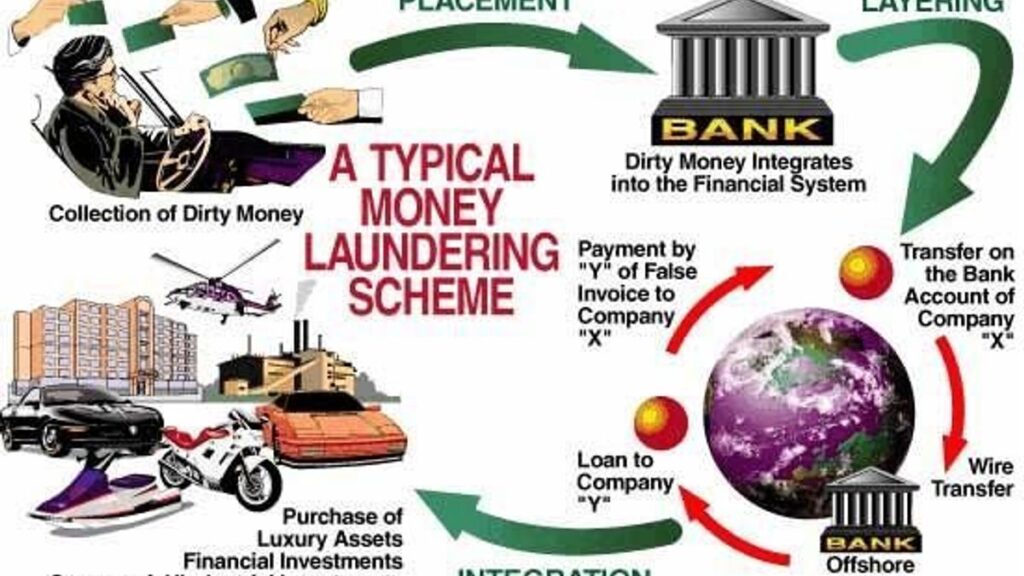

Classic Money Laundering

Classic money laundering is literally cleaning up your money. “Breaking Bad” is an example of that. “This is a nail salon, right? I take your dirty money, and I slip it into the salon’s nice clean cash flow. Final step, integration. The revenues from the salon go to the owner. That’s you. Your filthy drug money has been transformed into nice, clean taxable income brought to you by a savvy investment in a thriving business”, a conversation between two characters which displays “Classic money laundering”. You’re trying to conceal the nature, origin, or source of criminal proceeds, so if they’re discovered, they’ll look legitimate.

Potential Reasons For Money Laundering

- Money laundering can also be used to finance terrorism. Terrorist organisations often rely on money laundering to fund their activities. By using complex networks of shell companies and offshore accounts, terrorists can move money around the world without raising suspicion. The use of anonymous digital currencies like Bitcoin has also made it easier for terrorists to move money around the world without detection. This makes it difficult for law enforcement agencies to trace the source of the funds and disrupt terrorist activities.

- Some criminals also engage in money laundering as a way to launder their reputation. For example, a criminal who is known for engaging in illegal activities may use money laundering to create a façade of legitimacy by investing their illicit funds in legitimate businesses or charities. This helps to create a positive public image and can help to deflect attention away from their criminal activities.

- In addition to the motivations mentioned above, there are several other factors that can contribute to the prevalence of money laundering. One of these factors is globalisation. As businesses and individuals operate across borders, it has become easier for criminals to move money around the world without detection. The rise of the internet and digital currencies has also made it easier for criminals to engage in money laundering.

Conclusion

Money laundering has a devastating impact on the global economy. It leads to the creation of a shadow economy, where illicit funds are moved across borders, often with the assistance of financial institutions. This shadow economy is vast, and its size is estimated to be around 2% to 5% of global GDP, which is around $1.5 trillion to $3.5 trillion annually.

Money laundering is a serious crime that has far-reaching consequences on the global economy. Criminals engage in money laundering to conceal the source of their funds, evade taxes, finance terrorism, hide the proceeds of other crimes, and launder their reputation.

If you liked this reading, and want to read more of our handcrafted blog posts, visit our Blog page.

No responses yet