I started a series called Stock Picks of the Week about 3 months back. Since then I’ve realized that when finding investments which are worth their value, a week is far too less time to find a true gem of a stock. It takes weeks, to find a few stocks good on the surface, but months more to find one worth the investment. This is why the series will now continue like this; randomly timed posts about stock picks whenever I find a great investment. This post, I hope, is one such potential investment.

UPL

UPL is my stock pick for this post. It strikes off all the areas for a value investor: Poor 52 week performance and results but with an optimistic future, improving fundamentals, great financials, great management and amazing value. On the surface, UPL seems like a very obvious no-go, but on diving deeper, it becomes clear that the stock could very well be a great investment.

Company Overview and History

UPL is one of the world’s biggest crop protection, agrochemicals, industry chemicals, and sustainable chemicals producers in the world. It has been in this business for 50+ years, and has established itself as one of the best in the world in this sector, with presence across 138+ nations. Run by the same family that founded it since its inception in 1969, the company has always had experienced leaders at its helm. Today it is run by the two sons of the founder, Rajnikant Shroff: Jai and Vikram Shroff. The business of the company, at its core, is post-patent agrochemicals, but the vision of UPL is gradually moving more towards being a company offering differentiated and sustainable crop protection solutions and bio-solutions. UPL generates revenue from 4 major businesses and subsidiaries, which are the main crop protection business, their specialty chemicals business, followed by their sustainable agri-solutions business and their sustainable seeds subsidiary, Advanta.

Poor 52-Week Performance and Results

At the time of me writing this post, UPL, has just reached a new 52 week low. For the last year and a half, it has consistently been one of the worst performing stocks on the market. Its results, only two weeks old, mirror the same. Revenue increase year on year, but net profits, margins and almost all major criteria declining from Q1 of last year. The company reported a net profit of ₹166 crore in the quarter, registering a fall of 81% from ₹877 crore year on year. The already low guidance was also sharply reduced. UPL now predicts revenue growth of 1-5% in FY24 as compared to the 6-10% increase forecasted earlier in the year. It also cut its EBITDA growth guidance for the year to 3-7% from 8-12%. There is no sugarcoating the fact that these results are bad. Most of this poor performance, especially at a time where the market is around all time highs, is due to exceptional behaviour in the international agriculture market, largely due to stiff competition from Chinese exporters and weak monsoons and harvests. As a result of these events, UPL’s biggest revenue share business, their crop protection side of the company, has been impacted heavily, having already low margins cut, and experiencing extreme dips in profits. Despite this, the company’s future outlook seems to be positive, and it should have the experience and the capability to come out of this phase stronger.

Positive Future Outlook

Despite the rough few quarters UPL has been through, the long term future outlook of the company is positive, for many reasons. Firstly, the current headwinds being faced by UPL and the rest of the global agrochemical industry, are set to subside somewhere around the halfway point of this financial year, indicating that revenues, profits and margins will jump, if not to highs, at least to the standards of previous years.

Another positive for the long term is UPL’s stance on debt. UPL, has had a debt to equity ratio of around 1, for many years now, which has driven many safe-playing investors away. However, in the last financial year, UPL has started to focus critically on its net debt, and has laid out future plans for resolving the same. By utilizing improved cashflows, last year alone, UPL was able to cut its net debt by almost half a billion dollars, to a remaining 2 billion dollars, and is hoping to continue to do so in the following quarters.

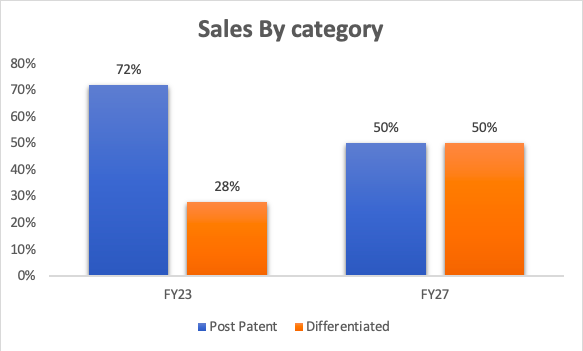

As I mentioned before, UPL’s main business, the agrochemical/crop protection business generates the most revenue for the group as a whole. However, its margins, and ratios are really not top of the line when it comes to a comparison with its competitors, due to its post-patent business type. This has resulted in return on equity at 13%, net profit margin of 7%, and return on capital employed of 15% for the company as a whole, which are all below competitors. The only segment where UPL are miles ahead of its peers is in revenue growth, which has been at a steady average of 20% annually for the last 15 years. However, revenue growth too, is forecasted to dip this financial year due to the crop protection business being affected. In fact, that is the segment of the company pulling overall profits and margins down the last few quarters, but there is a brighter side to the story. First of all, the crop protection business is moving away from the post-patent direction its been following, to a more differentiated portfolio, which will help ramp up margins. Secondly, the other 3 major business of UPL have, despite the overall company’s poor performance , have been performing very well, generating such great revenues, profits, and margins, that their revenue share of the total revenue of the company is expected to increase to almost 50% in the next 5-7 years. This means that in the long term, UPL will most likely have much better margins and ratios, and a much more diversified revenue portfolio.

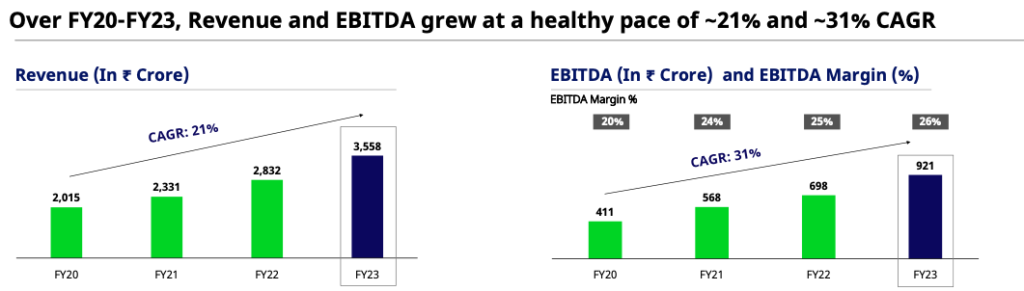

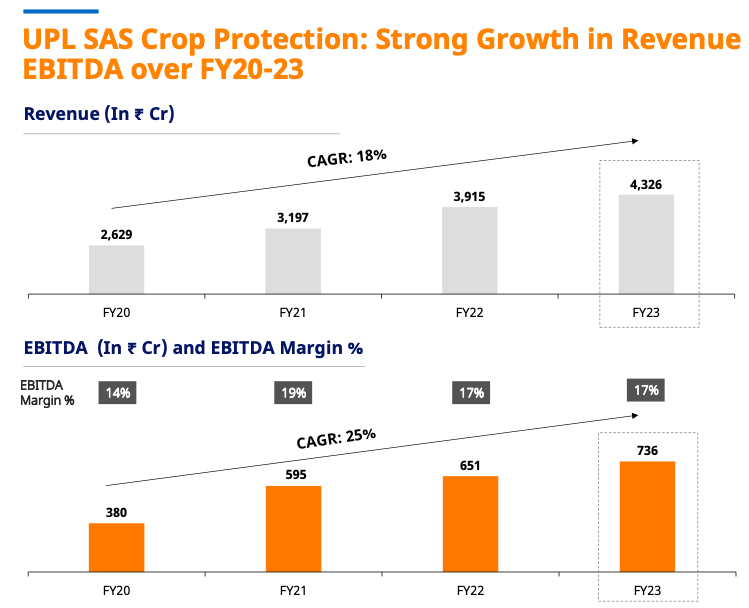

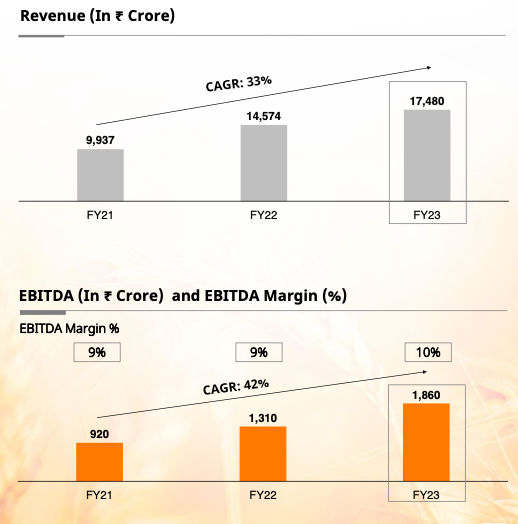

Talking about diversification, the 3 smaller entities of UPL, unlike the crop protection, have been performing at great standards. UPL SAS, the sustainable solutions business, and Advanta, the seeds business, both have been growing at rates which have positively surprised investors and directors alike. Both have seen revenue and EBITDA CAGR rates of almost 25% each over the past 3 years, with Advanta having great EBITDA margins of 24%. These numbers are forecasted to continue increasing over the next 5 years and onwards. Even the specialty chemicals business has been doing very well and is increasing its footprint over the market, with a revenue growth CAGR of 33%, and EBITDA growth CAGR of 42% with steady margins in the last 3 years. This adds to another great aspect for the business: diversity in portfolio.

Advanta Numbers

Sustainable Solutions business numbers

Spec chem business numbers

The final reason behind why I am optimistic about UPL’s future outlook, is the importance it gives to sustainability. It is not an unknown fact now, that in the coming years and decades, sustainability is going to be a critically important aspect of any and every business. UPL is one of the few companies already so heavily invested into this category. With a separate, rapidly growing division of sustainable agri solutions, and the aim to make almost half of the company’s products sustainable, I have immense faith that when the world, and the agricultural industry moves completely into sustainability, UPL will have a seamless transition.

Great Management

Looking away from outlook, fundamentals and other metrics, UPL simply put, is a company led by experienced, determined and capable leaders. Led by by the brothers who have spent their entire lives in the agriculture industry, trained by their father and revolutionary founder, the helm of the company is in good hands. The board of directors also, is extremely experienced and with extensive knowledge of the business. All four businesses of the company are also led by competent, proven leaders. The management of a company is extremely important to look at when finding an investment. At the end of the day, these are the people running the business, and any obstacles the corporation faces, is handled by them. The presence of capable and talented leadership can make or break a company, and in UPL’s case, it is my opinion that that its leaders can steer the group out of this difficult time.

Enticing Value

Finally, what I feel should be the point when investors should really find faith in UPL, is its value. I used multiple methods to take out the intrinsic value of UPL, including a discounted cash flow method, EPS method and Graham Number method. After using all of these tools, I can say with confidence, that the current share price of UPL is discounted to its intrinsic value by more than 50%, with the fair value being about 1300 rupees per share. This increases the margin of safety and conversely decreases the risk involved in the investment by a large percentage.

Conclusion

Overall, I feel UPL is a great investment. It’s a well established company led by an experienced management team, and has grown solidly when it comes to revenues, profits and margins in the past 5 years plus. It is going through a rare rough patch as of now due to global industry wide slowdowns, but because of its extensive portfolio of products and sustainable solutions should be able to rebound in the next half of the financial year and recover post that. Its future outlook, governed by smart decisions involving sustainability, diversification and debt reduction, is very optimistic, and considering its discount to intrinsic value, it is my belief that UPL is a low risk high return potential stock.

If you liked this reading, and want to read more of our handcrafted blog posts, visit our Blog page.

Financial disclaimer: BullishBehaviour and its team members are not registered as financial advisors and hold no formal qualifications to give financial advice. Everything that is provided on this server, on the BullishBehaviour website or by BullishBehaviour and its team members is purely for educational purposes only. BullishBehaviour and its team members are not accountable or liable for any losses or damages. You are responsible for all the risks you take. Any content provided here should not be construed as financial advice.

ALL GRAPHS/GRAPH INFO IS FROM UPL’S ANNUAL INVESTOR PRESENTATION, NOT OWNED BY BULLISHBEHAVIOUR.

2 Responses

wow amazing

muy bien escrito!