It has been over 20 days since US President Trump announced his reciprocal tariffs. With investors’ initial panic having passed, we must take steps to understand the future of the Indian market and capitalise on the situation. A key to doing so is identifying which sectors could potentially benefit the most in this new global economic landscape.

Firstly, it is important to revisit what tariffs are. They are taxes imposed by one country on imports from another country to increase revenues and protect domestic producers. Trump’s primary motive for imposing reciprocal tariffs on over 50 countries is to help reduce the United States trade deficit. In essence, a tariff makes the goods and services from a foreign country costlier in the country of import, making domestic products more enticing for consumers. Regarding Indian products and the Indian market, the US tariffs have varying impacts on the different sectors.

India’s top exporting destination by a sizable margin, is the United States, with about 18% of the country’s exports or around $85 billion worth of trade. The second country on this list, the UAE, contributing to just 8% of exports, makes it evident that India relies heavily on the US for its export revenues, signalling that it is a trade partner the country cannot easily replace. This makes it clear that despite the tariffs imposed on Indian products, companies are unlikely to stop exports to the US in the foreseeable future. However, to maintain competitive prices in the US, Indian companies will be forced to lower prices to reverse the effects of the tariffs. Mathematically, charging lower prices will lead to lower margins for these companies, stressing their financial health.

Sidestepping from tariffs, India’s economy is at a fair, acceptable standpoint. With cooling inflation allowing for rate cuts, now is as good a time as ever for consumers and businesses to borrow funds for cheap. Considering the tariffs, companies may borrow funds to meet operating expenses on lower margins and revenues. Such high lending volumes highlight that Indian banks will likely benefit from the tariffs imposed by the US.

April 9th saw the RBI cut the key repo rate by 25bps to 6%, with optimism on further cuts to follow. Although rate cuts could impact margins, the higher volume of borrowing brought about by them and the tariffs will help offset the impact while increasing revenues. All these insights highlight that the sector to invest in now, is banks, specifically private sector banks for their higher risk-taking capacity.

Although the Nifty Bank has already seen a 7% gain in the last month resulting from strong March quarter results, two hot bank stocks, remain undervalued. Both HDFC Bank and ICICI Bank despite their already bullish runs are strong long-term investment bets.

Based on my DCF (Discounted Cash Flow) model, HDFC Bank and ICICI Bank shares are undervalued by 45% and 65% respectively. With soaring free cash flows and a healthier economic environment, these undervaluations show that both stocks have higher room for returns. Both banks have also posted strong quarterly results, bolstering their stands as solid investment options.

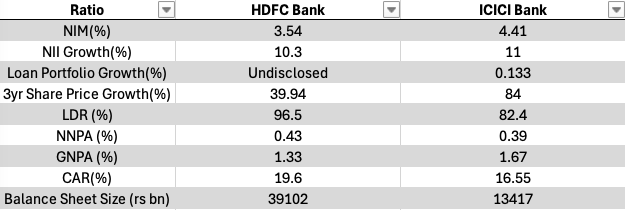

Comparing their results, however, brings unique conclusions. Both banks, with their low net NPAs (Non-Performing Assets: Loans on which borrowers have defaulted), have once again shown that they are the gold standard in Indian banking for risk management.

HDFC Bank has long been the industry leader in almost every growth, safety and valuation metric. It boasts incredibly steady returns over the last two decades, with unmatched revenue and net profit CAGR percentages of 25 and 26 respectively in the past 17 years. Its massive balance sheet also gives it the advantage of size over other private banks.

However, in the years following its merger with HDFC, HDFC Bank has faced critical challenges. The merger significantly increased the bank’s loan portfolio without affecting its deposits, leading to an inflated LDR (Loan-to-deposit ratio) of almost 100%. In efforts to bring this ratio down to desired, pre-merger levels of 85-90%, the bank has had to issue lesser credit and increase its deposits, impacting its NIMs (Net Interest Margins) and its NII growth (Net Interest Income) as well.

Although the merger has helped HDFC Bank increase revenues and growth to a certain extent, its core banking business is still in the process of adjustment. This is where ICICI has made strides. Over the last 3 years, the company has outperformed HDFC Bank by a large margin, delivering stronger results and experiencing a rise of over 85% in its share price.

With the recent results, it also seems a change of guard has come about, with the troubled post-merger HDFC Bank now second to ICICI Bank in most metrics.

Growth-wise, ICICI has overtaken HDFC Bank on most metrics, but in terms of size, capital strength and asset quality the latter is still the market leader.

While a diversified position in both stocks would make sense, it is important to uncover which bank makes for a better long-term investment.

Both banks are D-SIBs or Domestic Systematically Important Banks as categorized by the RBI. This means that both HDFC Bank and ICICI Bank are “too big to fail” and would be supported by the government if they were on the brink of collapse. Aside from their strengths in asset quality, this adds a further layer of security for both banks.

As discussed earlier the intrinsic, or fair value of both of the banks’ shares are much higher than their actual market prices. ICICI Bank is undervalued by about 65% with its fair value being 4000 rupees a share, and each share of HDFC Bank has an intrinsic value of about 3500 rupees, making it undervalued by about 45%. Both shares here show that they are at heavily discounted prices and with the current economic conditions, should begin to appreciate towards their fair value.

HDFC Bank’s merger should be kept in mind. Although the stock’s banking ratios have struggled post-merger, the bank’s revenue and profit growth have remained stellar. With the bank working towards bringing its LDR down and expecting loan volumes to rise more than the industry average this fiscal year, it will not be long before HDFC Bank re-emerges as the industry leader for most metrics.

While ICICI Bank has and will continue to see strong share price growth thanks to its strong growth and profitability, HDFC Bank’s asset quality, balance sheet and track record cannot be ignored, making it a better long-term option. For a short to medium-term investment with moderate risk, ICICI Bank is a solid option, while HDFC Bank is a smart choice for a conservative, long-term investment.

To conclude, the US imposed tariffs, as a ripple effect will lead to increased growth and performance in the Indian private banking sector, especially for players like HDFC Bank and ICICI Bank, making them prime investment options.

If you liked this reading, and want to read more of our handcrafted blog posts, visit our Blog page.

Financial disclaimer: BullishBehaviour and its team members are not registered as financial advisors and hold no formal qualifications to give financial advice. Everything that is provided on this server, on the BullishBehaviour website or by BullishBehaviour and its team members is purely for educational purposes only. BullishBehaviour and its team members are not accountable or liable for any losses or damages. You are responsible for all the risks you take. Any content provided here should not be construed as financial advice.

No responses yet