With the Federal Reserve set to cut interest rates for the first time in four years, now seems like a good time as any to understand what interest rates are, and the role of the Fed in enacting monetary policy.

What is the Federal Reserve?

The Federal Reserve System, more commonly referred to as the Fed, is the central bank of the United States, currently chaired by Jerome Powell. It is arguably the most influential financial institution in the world, established to conduct national monetary policy, regulate banking, and ensure financial stability. In its aim to ensure stable prices and maximum employment, interest rates are its main tool.

Understanding the Federal Funds Rate

The interest rate that the Fed controls is known as the Federal Funds Rate. Simply put, the Fed Funds Rate is the interest rate banks charge each other, and other institutions, when lending money to them overnight. Since banks must meet a reserve requirement, and have a reserve equal to a certain percentage of their deposits in a Fed account, the exchange of funds between banks with excess balances and those expecting shortcomings in their balances occurs often. The fed rate acts as a benchmark for the rate banks charge each other. While the fed rates do not directly determine other interest rates, it has a large influence on their fluctuations as well.

Influence of the Fed Rate

The fed rate has direct impacts on the financial conditions of the country, especially the economical aspects for which it is adjusted, such as inflation, employment and overall growth. The rate also has tremendous influence on the prime rate, the rate banks charge their most creditworthy borrowers. Lenders set rates on everything from auto loans to card rates based on the prime lending rate, which makes the Fed’s impact spread across the financial landscape of the country.

Reasons for Rate Cuts

The Federal Reserve adjusts the Federal Funds Rate based on the macroeconomic conditions being faced by the economy, specifically inflation and unemployment rates. With inflation and unemployment usually seen in an inverse relationship, the Fed determines a benchmark for the ideal rate of inflation, for which it further sets a target rate for the Federal Funds Rate in order to achieve the benchmark. For a simple example, in times of high inflation, the Fed, aiming to ease price changes and provide stability, increases the reserve rate. In doing so, the Fed increases borrowing costs and to an extent, discourages excess spending of consumers and businesses, helping lower inflation to a desirable point.

Current Scenario

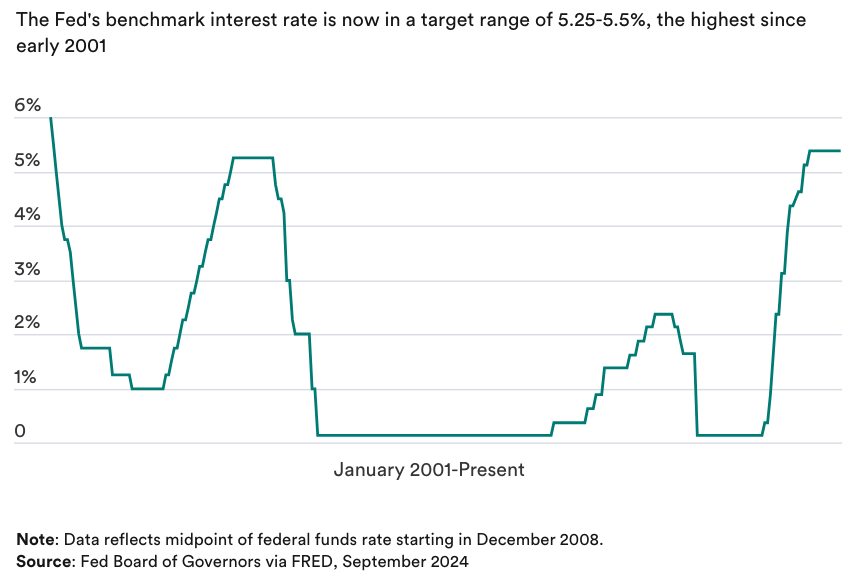

The Fed is supposed to announce its first rate cut in 4 years on the 18th. This comes after the Fed began increasing rates at the fastest pace in four decades in response to surging post-covid inflation rates, with inflation touching 9% in 2022, and lifted its benchmark rate from near zero levels all the way up to 5.25-5.5 % in a year and a half. With underlying inflation still above 3% as of last summer, the Fed kept its benchmark at 5.25-5.5% in order to bring down inflation and control the labour market.

Source: https://infogram.com/fed-funds-rate-graphic-econ-survey-1h7j4dv8xvpl94n, Bankrate.

Coming to the present, most inflation metrics are below 3%, within reach of the Fed’s target rate of 2%. Unemployment is reaching high levels, highest in the last 3 years. Inflation seems to be on the downtrend as well, with the PCE or price index of personal-consumption expenditures, the preferred price index of the Fed, projected to reach 2.10% by 2025, almost within the 2% benchmark set. Crude oil, being a major economic input, also has an impact on overall inflation, depending on its per barrel price. Plunging oil prices hence also point towards a declining inflation rate. Economic growth is decreasing, inflation is low, and unemployment seems to be increasing, it is no surprise the time for a rate cut has come.

Considering these scenarios, a rate cut seems more than relevant today, and in hindsight, delayed. The Fed, although having brought down inflation from an alarming 9% rate to a much more manageable sub 3% rate, it can be argued, played a major role in allowing such inflation rates to occur in the first place. It is of critical importance that the decision it makes on Wednesday pushes the economy in the right direction. With the scrutiny and critical commentary the Fed has received on its rate policy in the past few weeks, with the current macroeconomic conditions and cries of a recession, Jerome Powell has no choice but to cut the Federal Reserve Rates.

The much more important question that rises however, is how much should the rate be cut down to. The prevailing market opinion rests between a half percent cut, and a quarter percent cut; both presenting their own advantages and challenges. With political implications also on hand, with the presidential elections inching closer, the Fed’s job becomes even more complicated.

Some argue that since, it has become more than clear that the current Fed rate is far beyond what the rate should ideally be, a 50 basis point, or half percent cut is warranted. A fifty basis point reduction would stimulate spending, and help in easing unemployment conditions. However, if the changes in unemployment, with the possibility of the currently volatile oil prices to rebound increase the inflation to a relatively higher rate, it would undo the Fed’s work in its reduction in the last two years and signal off any further rate cuts.

Many argue for a 25 basis point, or quarter percent rate cut, arguing for a gradual movement to the desired benchmark rate of 2%. However, considering the worldwide economic slowdown, this could prove to be an equally, if not riskier move.

Despite the rate cuts, the S&P will continue to be overvalued severely, based on the earnings its listed companies generate. However, the cut would allow for investors to have increased optimism in the market, especially for utility and real estate stocks with high dividends. The rate cut would further mean reduced cost of capital for companies, which could again lead to increased investment. These conditions paired with the fact that lowered interest rates make stocks more attractive than bonds, signal a rather immediate increase in stock market investment, with the rate cut being considered a sign of growth for many.

Overall, with the current economic conditions, Jerome Powell and party have a decision of critical importance: cutting interest rates by an amount that would not lead to a return to post-covid inflation, and ease unemployment.

If you liked this reading, and want to read more of our handcrafted blog posts, visit our Blog page.

Financial disclaimer: BullishBehaviour and its team members are not registered as financial advisors and hold no formal qualifications to give financial advice. Everything that is provided on this server, on the BullishBehaviour website or by BullishBehaviour and its team members is purely for educational purposes only. BullishBehaviour and its team members are not accountable or liable for any losses or damages. You are responsible for all the risks you take. Any content provided here should not be construed as financial advice.

No responses yet